Because many organizations tend to use accrual accounting, the income statements they release periodically may not necessarily reflect changes in their cash positions. This is mainly because the revenues reported may not have been collected and similarly, the expenses reported on the income statement might not have been paid. So a cash flow report is required to show the actual cash that was generated and used in a given period as opposed to the incomes and expenses that are reported.

Loan Performer has incorporated the Cash Flow Report to report the cash generated and used during a given period. It organizes the report under the following categories:

- Operating Activities:

The operating activities on the Cash Flow Statement include any sources and uses of cash from business activities. In other words, it reflects how much cash is generated from a company's products or services.

Generally, changes made in cash, are reflected in cash from operations. These operating activities might include:

• Receipts from sales of goods and services,

• Interest payments on loans,

• Income tax payments,

• Payments made to suppliers of goods and services used in production,

• Salary and wage payments to employees,

• Rent payments,

• Any other type of operating expenses.

ii. Investing Activities:

Investing activities include any sources and uses of cash from a company's investments. A purchase or sale of an asset, (a purchase is cash out and a sale being cash in) loans made to clients or received from customers or any payments related to a merger or acquisition are included in this category. In short, changes in equipment, assets, or investments relate to cash from investing.

Usually, cash changes from investing are a "cash out" item, because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities. However, when a company divests an asset, the transaction is considered "cash in" for calculating cash from investing. For more on how cash flow from investing activities is calculated, please see Cash Flow From Investing Activities.

iii. Financing Activities:

Cash from financing activities include the sources of cash from investors or banks, as well as the uses of cash paid to shareholders.

- Payment of dividends,

- Payments for stock repurchases and the repayment of debt principle (loans) are included in this category. Changes in cash from financing are "cash in" when capital is raised, and they're "cash out" when dividends are paid. Thus, if a company issues a bond to the public, the company receives cash financing; however, when interest is paid to bondholders, the company is reducing its cash. For more on how cash flow from financing activities is calculated, please see Cash Flow From Financing Activities.

Note tha all the above activities have an element of cash coming in (Sources) and cash going out (Application/uses). and this is what defines the flow of cash over a period.

There are two standard methods of reporting cash flows:

- The Direct method whereby major classes of gross cash receipts and gross cash payments are disclosed.

- Indirect method whereby the net income is adjusted for the effects of transactions of a non-cash nature, accruals of receipts or payments, and items of revenue or expense associated with investing or financing cash flows

Loan Performer is mainly a cash based system therefore more suitably uses the Direct Method to configure and set up the format and content of the cash flow report.

How to configure Cash Flow Settings

Defining the cash flow settings involves 3 stages:

1. Adding the Report Titles.

2. Adding the Report Headers.

3. Adding the Report Label and the corresponding accounts.

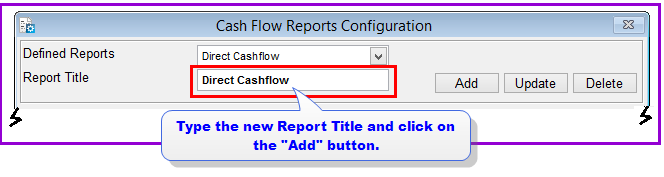

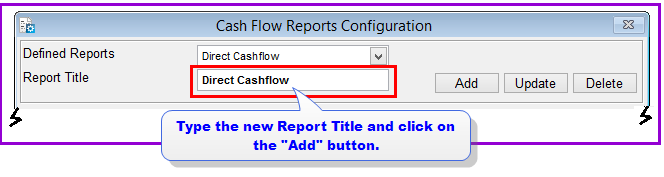

1. How to Add Report Titles

To add cash flow report titles you go to Systems->Configuration->Cash Flow settings and a screen like the one below shows up:

Click on the Add buttonand thenew report title will be added. Repeat this for all the reports titles that you want to add.

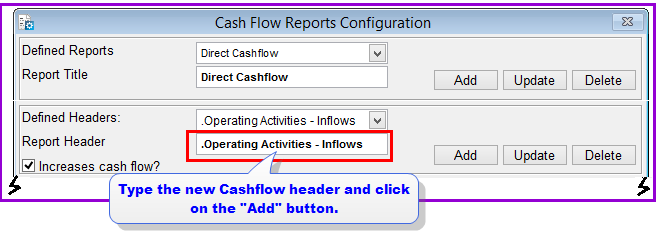

2. How to add the Cashflow report headers

To add cash flow report headers you go to Systems->Configuration->Cash Flow settings and a screen like the one below shows up:

Click on the Add buttonand thenew header will be added. Repeat this for all the headers that you want to add.

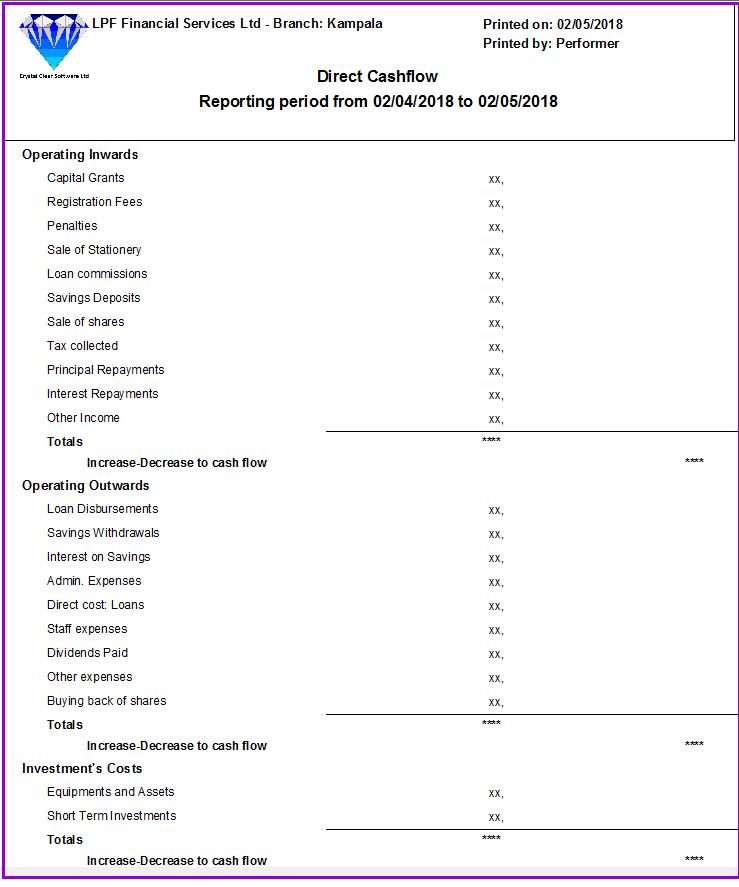

After fully defining the layout of your Cash Flow Statement, you can preview it by clicking on the Preview button.

Click on the Close button to exit. .

The Nº 1 Software for Microfinance